Bakken Formation petroleum resources – a few words about types of resources

UPDATE (July 2008): To learn more about the geology of the Bakken petroleum system, check out this study by Flannery and Kraus from 2006.

UPDATE (June 2008): I have edited the text from the original version of this post in April 2008. I incorrectly used the word “reserves” when I should’ve been using “resources”. In addition to that, I was using them inconsistently! My bad … thanks SF!

–

Reports, blurbs, and blog posts related to a USGS assessment of the petroleum resources of the Bakken Formation (Williston Basin, Montana and North Dakota) motivated me to look at the report in a little more detail.

Now, whether or not the resources should be developed is a question I’ll come to at the end of the post. I think, regardless of how you might answer that question, it is important for an entity like the USGS (as opposed to the private sector) to carry out these assessments. More knowledge is beneficial for making decisions.

The USGS puts together these great summaries, called “fact sheets”, for a lot of the work they do. Having done some work with the USGS myself, I found myself going back to their fact sheets for other topics over and over again. I’m sure one can nit-pick and find problems with them … blah blah blah … but, for a high-level overview, these are fantastic. You can find and download the PDF for the fact sheet for the Bakken resource assessment here. Much of what I outline below comes directly from that summary.

The map below shows the area of interest. The red line is the approximate boundary of the Williston Basin province, and the blue line is the boundary of the USGS’s total petroleum system (TPS) assessment.

What does total petroleum system mean? To accurately assess petroleum resources, three general aspects must be considered: (1) source rock, (2) reservoir rock, and (3) trap formation/timing.

The shales of the Bakken (Upper Devonian-Lower Mississippian) are already known to be a source rock for younger reservoir intervals in the Williston Basin. In terms of reservoir, the Bakken has a middle sandstone member that is thought to be widespread and a good candidate for a conventional reservoir unit.

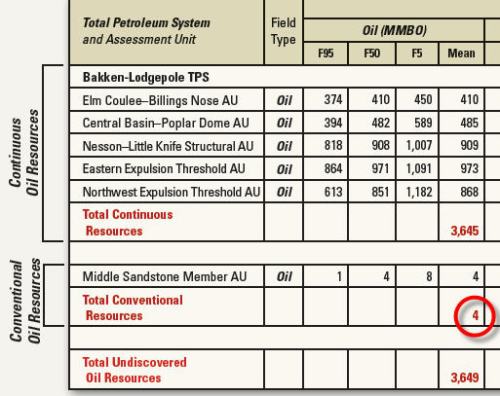

Now, here is the crucial part of all this. This report concludes with some rather large numbers of recoverable resources – greater than 3.6 billion barrels of oil. Below is the summary table for these numbers. The total undiscovered resources is at the bottom right.

There are two types of resources reported here – continuous and conventional. Note that the conventional resources are a mere 4 million barrels, or 0.001% of the total reported undiscovered resources (I’ve circled it in red above).

Conventional resources are those that we can recover with existing drilling and production technologies and within the general current economic state. Continuous resources (which are sometimes grouped into the “unconventional” category by other assessments) are a different story.

So, then what exactly are “continuous” resources? This USGS site states:

The U.S. Geological Survey has defined a new type of hydrocarbon accumulation which is not trapped in the conventional sense because the accumulation is not significantly affected by the water column. These unconventional accumulations are areally large and are termed continuous because the reservoir rock is charged with oil or gas throughout. Many examples of continuous accumulations can be found in the United States. In conducting the 1995 National Assessment of Oil and Gas Resources, U.S. Geological Survey scientists included this new category of accumulation because of the large quantities of technically recoverable hydrocarbons, mostly gas.

The resources are technically recoverable in the sense that we could extract them if really wanted to. This is an extremely important distinction between what is economically recoverable. In other words, even though one could technically recover the oil, if the cost to recover it was far greater than what one could get when they sell it on the market, what’s the point. It’s uneconomic.

So, while quantifying unconventional resources is certainly important for getting a handle on what’s down there, they can be a bit misleading when reported in the mainstream media. The big wildcard in unconventional petroleum resources is, of course, the price of oil. As the price of oil goes up (increasing global demand + diminishing supply), the economics of recovering these unconventional resources starts to work out.

Personally, I think it’s important to acquire knowledge about such unconventional petroleum resources, but I don’t think we ought to focus our efforts on developing technologies that extract such resources at lower costs (thus making the economics work better).

Do we need petroleum? Yes, indeed. Are we going to need it for some time to come? Yes again. Anyone who thinks the world can operate as it is now without it is out to lunch. Of course, this doesn’t mean we don’t work hard to get ourselves off the stuff. I really despise false dichotomies in general and the one that arises in the energy debate is no oil vs. only oil. The former is unrealistic and the latter lacks vision and is typically driven by power/greed. Admittedly, the ‘we-need-to-get-off-of-all-oil-today’ argument may help to drive public opinion and attitude … I can appreciate that. But, when it comes down to actually making progress regarding energy solutions, we need practical solutions in addition to opinion and attitude. On the flip side, those who are constantly claiming how little alternative energy solutions make up our overall energy portfolio, as if that proves that it’s unimportant and we shouldn’t pursue it, are disingenuous at best.

So, should we start putting all our efforts to recover this resource? Personally, I would say no … at least, not yet. But, that’s just my own opinion. When I was doing a bit of web research for this post, I found myself on some right-wing blogs that were talking about how these resources would solve all our energy problems. This is a very weird thing to say, especially coming from people claiming to be free marketeers. Just because the petroleum is within the U.S., doesn’t mean it’s ours. We don’t have a nationalized oil company*. Companies that extract it, need to sell it on the market. It’s a commodity. The only oil that is truly nationalized is the Strategic Petroleum Reserve (SPR). All this rhetoric about “our” oil (this goes for ANWR and the OCS too) implies a completely different commercial model. Are those people advocating nationalization of America’s resource?

My main point here is to be aware of the different categories of resources that you might see reported in the media. Big numbers will be thrown around and hyped and it’s important to realize exactly where they come from and how they were determined.

–

* By the way … a little factoid for you – less than 10% of all the worlds oil production comes from the major international oil companies … the rest comes from the numerous national oil companies around the world [link].

Brian, I think this is a really informative post, and I really like the calling of “false dichotomies” that so often come out in debates about so many subjects.

I was wondering which oil companies (besides China’s) would come under the category of national oil companies? Interesting how that could change the future of oil production.

Saudi Aramco, the state-owned oil company of Saudi Arabia, is HUGE … I don’t have the stats at my fingertips, but my guess would be they are the biggest player of any single entity, state-owned or otherwise.

Petroleos de Venezuela, S.A., referred to as PDVSA, is Venezuela’s national oil company. Their biggest client is the United States.

Petroleos Mexicanos, or PEMEX, is another big exporter.

China National Offshore Oil Corp. (CNOOC), as you mention, is gobbling up leases all over the planet!

There a numerous others (e.g., SONANGOL of Angola), but I’m not sure how they all stack up together in terms of reserves.

The future of geopolitical relations as it relates to petroleum is within the hands of these state-owned oil companies.

Wow! And thanks.

“So, should we start putting all our efforts to recover this resource? ”

Who do you mean by “we”? If some enterprising inventor wan’t to form a start-up based on a new. clever, low-cost way of extracting oil, that’s great.

I might even buy 50 bucks of his 5 cent shares, on the off chance he actually does something useful.

The bigger more mature oil companies may choose to invest or not in his work using a more quantitative economic model.

I don’t see the purpose of the government quantifying sub economic resources. Once the technology is developed, then the developer can hire exploration companies to do that sort of thing. That’s like, our job.

As for state-owned companies vs private ones, developments like the Chinese interest in buying a 10% stake in BHP means that those lines are starting to blur.

“I don’t see the purpose of the government quantifying sub economic resources.”

Why not? You don’t think a national, or even global, assessment of resources, from a geologic point of view, from a single evaluator is useful? I think it’s very useful for forecasting (or attempting to) global energy scenarios.

Plus, you say ‘once the technology is developed’ … why would someone work towards developing technology if they were not aware of potential opportunities (as a result of the assessment of sub-economic resources)?

Natural gas from fractured rock has become a big deal (Marcellus Shale, Barnett Shale, plus all the coal-bed methane out there). But that’s methane, not oil. Does anyone get oil out of rock with permeability that’s mostly fractures? I’m not talking about hydro-fracturing – the natural joints in the Marcellus sound like they’re really important for recovery of the methane.

I’ve been wondering what to make of the Bakken news releases, and have wondered whether unconventional oil has become economic in the way that unconventional natural gas has. It sounds like it’s economic potential is still theoretical, at this point.

“Why not? You don’t think a national, or even global, assessment of resources, from a geologic point of view, from a single evaluator is useful? I think it’s very useful for forecasting (or attempting to) global energy scenarios.”

Assuming a semi-decent regulatory regime, exploration companies will pay money to lease ground and tell the government what they find there as part of the exploration conditions. As an example, the sub-economic X deposit that we spent last year drilling has been sent to the relevant geologic survey, and will become publicly available information whenever we relinquish the ground. Anyone curious about sub economic resources can then dig through the data and put the numbers together themselves. While they may not be super accurate, anyone who thinks a region is with looking at in greater detail can pick up the land and do a more thorough assessment (this is currently happening for Phosphorous).

So giving the government a regulatory and archival role instead of being a state-run exploration company means that you raise revenue instead of expending it, and it means that the decision-making of what to look for when and how hard is made at the entrepreneurial level, instead of my bureaucrats far removed from the actual rocks.

I think were mixing up two things here … above I’m talking about (1) the USGS as an entity for resource assessment, and (2) state-run oil companies in a global sense.

I’m not talking about the USGS being equivalent to an entity of ‘what to look for when’ … that’s not up to them. I’m not talking about an assessment for company X to decided to spend/make money, i’m talking about an assessment that is important for a bigger picture perspective of energy resources as a whole. The only way to get a sense of the whole is to look at all the little pieces. I still don’t understand why you think this is either wrong or a waste of time.

I’m saying that if all the exploration companies that make failed or subeconomic discoveries properly report their findings to the USGS (or whoever keeps track of such things) as part of their tenement rental, then the USGS doesn’t have to do assessments- they can just collate the data they have on file, as private companies have already done the work (and spent the money).

Hey Brian, thanks for this very informative post! I’ve heard some about this gigantic oil deposit waiting to be tapped thus freeing us from the bonds of overseas oil.

I didn’t know the USGS put out such informative and easily digestable material. Your post really put into perspective the viability of tapping that deposit.

Now, when I go to work, I can debate with everyone and really squash their hopes. lol.

Your statement that all the oil not produced by international oil companies is produced byu national OCs is false. Local independents (Mom & Pops) in the US produce large volumes of oil and gas and are small-business people who are disrespected by lumping them in with the big boys. DOn’t they have a right to make a living, or does the left reserve the right to tell us all what ways we may use to make a living?

OilyHands says: “Your statement that all the oil not produced by international oil companies is produced byu national OCs is false. Local independents in the US produce large volumes of oil and gas…”

The report I linked to at the bottom of the post states:

“The [Baker Institute for Policy] report notes that 77 percent of world oil reserves are in the hands of national oil companies and that the major international oil companies now control less than 10 percent of the world’s oil and natural gas resource base, with the remaining part of reserves controlled by partnerships between national oil companies and international companies.”

That leaves ~13-15% (depending on how much less than 10% they mean) not attributed to NOCs or major IOCs. So, sure … not all of it. But, within the context of a global resource assessment, that amount is not huge. I’m not saying it’s not significant for those smaller producers … but within the larger context it’s not much. Furthermore, that’s global … how much of that remaining percentage is just U.S. independents?

This is from this report … if you have information from a different study that has different numbers, please link to it.